Previous

3 THE MODEL

This section provides a brief overview of the technology platforms model of Economides and Katsamakas (2005) and extends that model to analyze the investment incentives of different platforms.

The model consists of two software ecosystems,

(i) the first based on a proprietary platform and

(ii) the second based on an open source platform.

The software ecosystem based on the proprietary platform consists of one platform firm selling the platform A, (operating system), and an independent application developer selling B, (application software).

The platform firm sells the platform to the users at a price p,. The independent application provider sells the application to the users at a price p,. The application provider pays also an access fees to the platform firm.

The fees is set by the platform firm and it can be negative when effectively the operating system firm subsidizes the application developer.

The demand function of the platform A0,

A0, is q0 =a0 - b0p0 – d1

and the demand of the application

B1 is q1 = a1 – b1p1 – d0

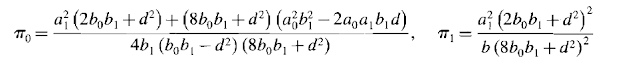

where parameter d measures the complementarity between the platform and the application. We assume that b1 , b0 > d, i.e. the own-price effect of each product dominates the cross-price effect. The profit function of the platform firm is

πo = p0q0 + sq1,

equal to the platform profit from users plus the platform profit from the application access fees. The profit function of the application provider is

π1 =( p1-S )q1 .

The marginal cost of production is zero for both the platform and the application, because both are software products easy to reproduce. The firms set prices in a two-stage game. In stage one, the platform sets the access fees paid by the application provider. In stage two, the platform and the application provider set the user prices p1 , p0 , simultaneously.

10.4.1 Innovation Incentives

Before the operating systems and the applications are offered to users as defined above, the software firms and individual developers may invest in increasing a, (effectively increasing the quality of the software product), expanding the demand of the operating system and the applications. We show that the incentives to invest differ across operating systems, and we characterize the relative strength of these incentives.

When the operating system is proprietary, we assume that

(a) each firm invests in its product to maximize its profit; and

(b) neither the users nor the application providers invest in the platform because the platform is closed.

For example, the quality of Microsoft Windows depends almost exclusively on Microsoft's investment in this operating system.

The proposition suggests that the investment in the application is stronger when the operating system is open source. However, the comparison of investment levels in the operating system is ambiguous. When there are strong reputation effects from participation in the development of the open source operating system, or a significant proportion of the users have also development skills, then the investment in the open source operating system is also larger than the investment of a firm controlling a proprietary operating system. The proposition captures both the reputation benefits and the usage benefits of participants inwidely adopted open source projects.

The application provider for the open source operating system invests more than the application provider for the proprietary operating system because the first has a larger marginal profit for all levels of investment.

This is because the open source operating system is adopted by users for free, enabling the application provider to set a larger price and capture a larger profit than the application provider for the proprietary operating system.

The level of investment in the applications affects the level of investment in the operating system because of the complementarity between the application and the operating system. In particular, when the level of investment in the application increases, the marginal benefit of investing in the operating system decreases, as shown in Equations (10.1) and (10.3).

Exogenous factors that reduce the adoption of the open source operating system, such as a large adoption cost

c0, decrease the incentives of individual developers to invest in the open source operating system. Therefore, an independent application provider may subsidize the adoption of the open source platform not only to increase the sales of its application, but also to increase the incentives of developers to invest in the operating system.

Last part

No comments:

Post a Comment